As we navigate the ever-evolving landscape of cryptocurrencies, it’s becoming increasingly clear that we may be on the cusp of another significant shift. Several key factors are aligning that could potentially trigger the next crypto boom within the next 1-2 years. Here’s why.

Lower Interest Rates: More Spending Power

Recent reports indicate that inflation is slowing down, with the Consumer Price Index (CPI) showing a decrease in inflation rates1. This development suggests that the Federal Reserve’s interest rate hikes are working, and if this trend continues, we might see a decrease in interest rates. Lower interest rates mean people will have more spending power, which could be channeled into investments in crypto and stocks. Here’s how:

- Increased Disposable Income: Lower interest rates mean lower costs for borrowing, including mortgages and other loans. This can result in more disposable income for individuals, some of which could be directed towards investments, including cryptocurrencies.

- Search for Higher Returns: Traditional savings and investment products like bonds tend to offer lower returns in a low-interest-rate environment. This can lead investors to seek out higher-yielding assets. Given their potential for high returns, cryptocurrencies can become an attractive alternative for these investors.

- Increased Business Activity: Lower interest rates can stimulate business activity by making it cheaper for businesses to borrow for expansion or other investments.

- Risk Appetite: Lower interest rates often lead to a higher appetite for risk among investors. As cryptocurrencies are generally considered a high-risk, high-reward asset class, they could attract more investment in a low-interest-rate environment.

Bitcoin Halving: A Supply Shock

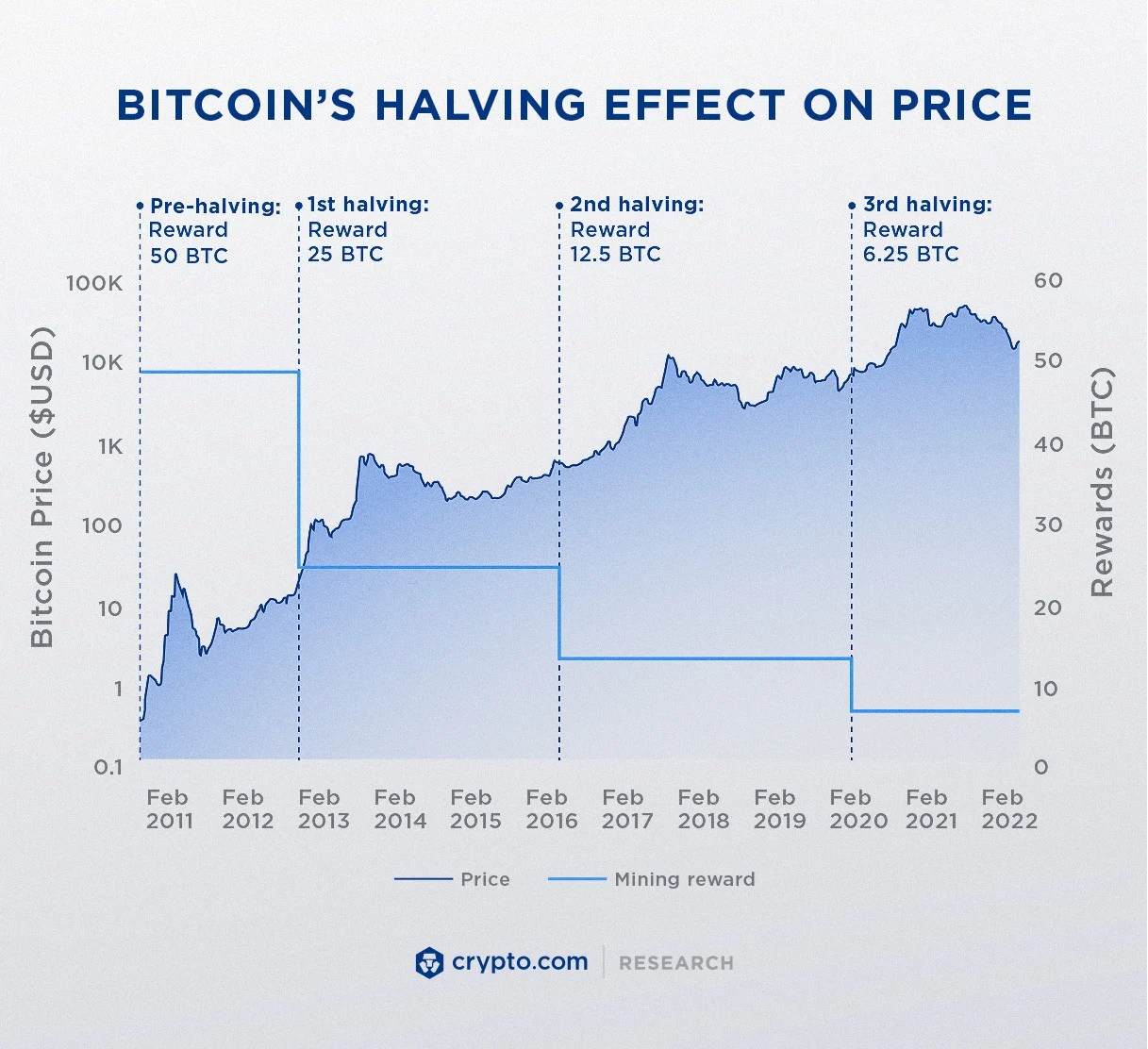

The Bitcoin halving, scheduled to occur in less than a year, is another significant event that could impact the crypto market. This event, which happens approximately every four years, will cut the supply of new Bitcoin in half. Historically, Bitcoin halvings have been associated with substantial price increases, and there’s no reason to believe the upcoming halving will be any different. The primary impact of Bitcoin halving is a reduction in the supply of new Bitcoin. When the reward for mining is halved, fewer Bitcoins are mined. This decrease in supply can lead to an increase in price. It is important to note that most of the Bitcoin that will be mined has already been mined so most people are not trading newly minted Bitcoin. Although the halving event underscores the finite supply of Bitcoin – there will only ever be 21 million Bitcoin in existence. This built-in scarcity is a key feature of Bitcoin and is often compared to the way gold, which is also finite, is valued. The halving event serves as a reminder of this scarcity, which can enhance the perception of Bitcoin as a store of value.

Bitcoin halving events are known well in advance, leading to increased speculation and trading activity as the event approaches. Traders and investors may buy Bitcoin in anticipation of potential price increases, which can itself drive up the price. Historically, Bitcoin halving events have been associated with significant price increases. For example, the last Bitcoin halving in May 2020 was followed by a substantial bull run that saw Bitcoin reach new all-time highs. While past performance is not a guarantee of future results, many investors look to these historical trends as an indicator of what might happen after the next halving.

Regulatory Clarity: A Double-Edged Sword

Regulation plays a critical role in the development and maturity of the cryptocurrency market. It can provide the legal framework and protections necessary for more traditional and institutional investors to enter the space, which can drive up demand and prices. The ongoing lawsuits and regulatory scrutiny by the U.S. Securities and Exchange Commission (SEC) could lead to more clarity about crypto regulation2. While these actions have caused some short-term uncertainty and price volatility, they could ultimately pave the way for more institutional adoption of cryptocurrencies. A clearer regulatory environment could attract more traditional investors to the crypto space, further driving demand.

Regulatory clarity can also provide better protection for individual investors, which can increase trust and participation in the crypto market which most would agree is much needed. Regulations can help prevent fraud, ensure fair trading practices, and provide a safety net for investors, making cryptocurrencies a more attractive investment option. These regulations can help prevent disasters like what happened at BlockFi, Celsius, FTX, MTGOX and more.

Clear regulations can also help standardize the way cryptocurrencies are treated globally, making it easier for businesses to operate across borders. This can stimulate innovation and growth in the crypto industry, potentially leading to increased demand and higher prices for cryptocurrencies.

Bitcoin ETF: A Gateway for Institutional Investors

A Bitcoin Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product, with shares that are tradeable on a stock exchange. A Bitcoin ETF tracks the price of Bitcoin, allowing investors to buy into the ETF without going through the process of securing, trading, and storing Bitcoin themselves. Bitcoin ETF’s come with a range of benefits including:

- Ease of Investment: Bitcoin ETFs simplify the process of investing in Bitcoin. Instead of buying and storing Bitcoin directly, which requires a certain level of technical understanding and poses risks in terms of security, investors can simply buy shares in the ETF. This makes Bitcoin more accessible to traditional investors who are familiar with buying and selling stocks.

- Regulatory Oversight: Bitcoin ETFs are subject to regulations that protect investors. This includes requirements for transparency, accountability, and security. This level of regulatory oversight can give institutional investors more confidence in investing in Bitcoin.

- Liquidity: ETFs are traded on traditional stock exchanges, which means they can be bought and sold throughout the trading day at prices that closely reflect their intrinsic value. This provides a level of liquidity that can be attractive to institutional investors.

- Diversification: Bitcoin ETFs offer investors a way to diversify their portfolios with exposure to Bitcoin, without the need to invest directly in the cryptocurrency. This can help spread risk and potentially improve returns.

The SEC’s recent acceptance of Blackrock’s Bitcoin ETF application is a promising development3. If approved, this would mark a significant milestone for the crypto industry, potentially opening the floodgates for institutional investors. The approval of a Bitcoin ETF could lead to wider adoption of crypto assets and products, further fueling the crypto boom.

Market Sentiment: The Tipping Point

All these factors are contributing to a shift in market sentiment about cryptocurrencies. We could be at an inflection point where the perception of crypto transitions from a speculative asset to a mainstream investment.

So, are we on the brink of the next crypto boom? While it’s impossible to predict with certainty, the signs are promising. As always, potential investors should do their research and consider their risk tolerance before diving into the crypto market. But for those who are ready and willing to ride the wave, the next couple of years could be an exciting time.

What do you think? Do you feel the winds of change stirring in the crypto world?